All Categories

Featured

Table of Contents

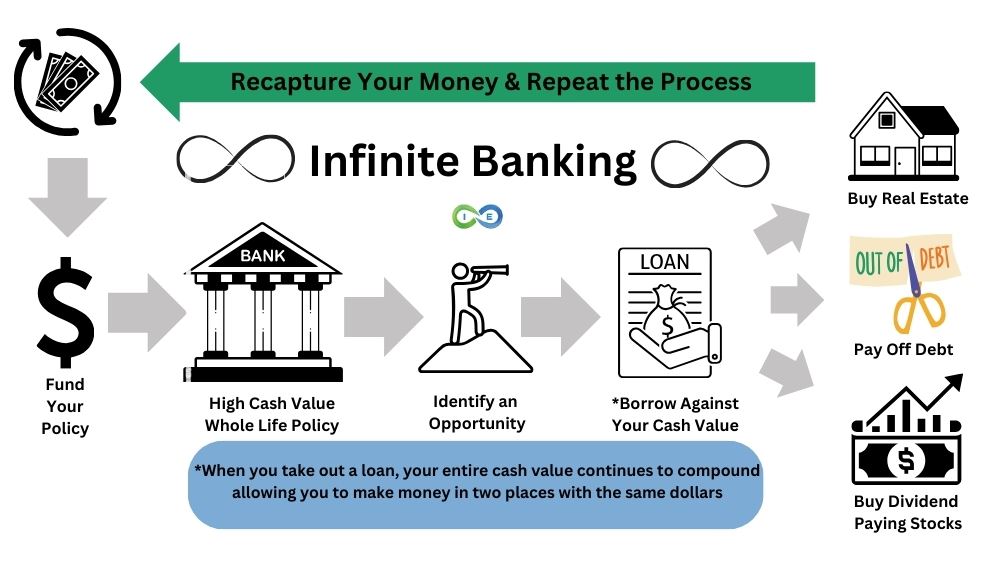

The method has its very own advantages, however it additionally has problems with high charges, intricacy, and more, leading to it being considered as a rip-off by some. Limitless banking is not the most effective plan if you require just the financial investment component. The limitless financial principle focuses on the usage of entire life insurance policy policies as a monetary tool.

A PUAR enables you to "overfund" your insurance plan right approximately line of it becoming a Customized Endowment Agreement (MEC). When you use a PUAR, you swiftly increase your cash worth (and your death advantage), thereby increasing the power of your "bank". Even more, the more cash money worth you have, the greater your rate of interest and reward payments from your insurer will certainly be.

With the rise of TikTok as an information-sharing platform, economic guidance and methods have actually found a novel method of dispersing. One such approach that has actually been making the rounds is the unlimited financial concept, or IBC for short, amassing endorsements from stars like rap artist Waka Flocka Fire - Infinite Banking wealth strategy. While the technique is currently prominent, its origins trace back to the 1980s when financial expert Nelson Nash introduced it to the world.

How do I qualify for Infinite Banking For Retirement?

Within these plans, the money value grows based on a price set by the insurance company. Once a substantial cash money value builds up, insurance holders can obtain a cash worth funding. These fundings differ from conventional ones, with life insurance coverage functioning as collateral, meaning one could lose their insurance coverage if loaning excessively without sufficient money value to support the insurance policy expenses.

And while the attraction of these plans is obvious, there are natural restrictions and threats, necessitating diligent money worth monitoring. The approach's legitimacy isn't black and white. For high-net-worth individuals or company owner, particularly those using strategies like company-owned life insurance (COLI), the advantages of tax obligation breaks and compound growth could be appealing.

The allure of unlimited financial doesn't negate its difficulties: Expense: The fundamental demand, a permanent life insurance policy plan, is pricier than its term equivalents. Qualification: Not everybody gets approved for entire life insurance policy due to strenuous underwriting procedures that can leave out those with details health and wellness or lifestyle problems. Complexity and threat: The complex nature of IBC, coupled with its dangers, may hinder numerous, especially when simpler and much less dangerous alternatives are readily available.

Infinite Banking Wealth Strategy

Designating around 10% of your regular monthly earnings to the policy is just not viable for the majority of people. Making use of life insurance policy as a financial investment and liquidity source calls for technique and surveillance of policy cash money value. Consult a monetary consultant to establish if unlimited financial aligns with your concerns. Part of what you review below is merely a reiteration of what has actually currently been claimed above.

Before you get on your own into a circumstance you're not prepared for, recognize the adhering to first: Although the idea is generally sold as such, you're not actually taking a loan from yourself. If that held true, you wouldn't have to settle it. Instead, you're obtaining from the insurance provider and need to settle it with rate of interest.

Some social media sites articles advise making use of money worth from whole life insurance policy to pay for charge card financial obligation. The idea is that when you pay off the finance with interest, the quantity will be returned to your financial investments. That's not exactly how it works. When you pay back the car loan, a portion of that interest mosts likely to the insurer.

What are the risks of using Whole Life For Infinite Banking?

For the initial numerous years, you'll be settling the compensation. This makes it incredibly tough for your policy to accumulate worth throughout this time around. Entire life insurance policy prices 5 to 15 times more than term insurance coverage. Most individuals just can't manage it. So, unless you can manage to pay a few to several hundred bucks for the following years or even more, IBC won't function for you.

Not everyone should count solely on themselves for financial safety. Self-financing with life insurance. If you call for life insurance policy, right here are some valuable tips to take into consideration: Think about term life insurance coverage. These plans offer coverage throughout years with substantial monetary commitments, like home mortgages, student financings, or when looking after little ones. Make certain to search for the best rate.

What are the tax advantages of Policy Loans?

Picture never ever having to stress about financial institution lendings or high rate of interest prices once more. That's the power of limitless financial life insurance policy.

There's no collection finance term, and you have the flexibility to decide on the payment routine, which can be as leisurely as repaying the loan at the time of fatality. This flexibility prolongs to the maintenance of the loans, where you can choose interest-only payments, maintaining the financing balance level and workable.

Cash Value Leveraging

Holding money in an IUL repaired account being credited interest can usually be better than holding the cash money on deposit at a bank.: You have actually always dreamed of opening your own pastry shop. You can obtain from your IUL policy to cover the first costs of renting a room, buying devices, and working with personnel.

Individual loans can be gotten from typical banks and debt unions. Right here are some key points to think about. Credit scores cards can give an adaptable method to obtain cash for extremely short-term durations. Nonetheless, obtaining money on a charge card is normally really costly with interest rate of rate of interest (APR) often reaching 20% to 30% or more a year.

Table of Contents

Latest Posts

Infinite Life Insurance

Can You Be Your Own Bank

How Do I Start My Own Bank?

More

Latest Posts

Infinite Life Insurance

Can You Be Your Own Bank

How Do I Start My Own Bank?